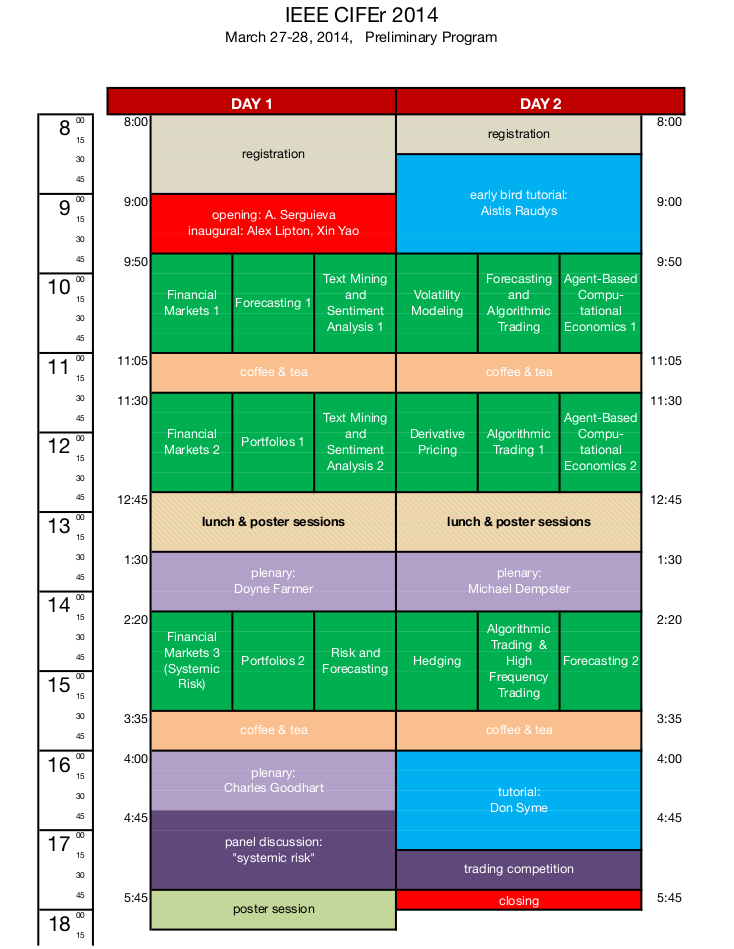

CIFEr 2014 Program

Schedule

Download program schedule (PDF) (last update March 19, 2014)

Download technical sessions schedule (PDF) (last update March 19, 2014)

Opening Address

Academia: Xin Yao, President elect, IEEE Computational Intelligence Society

Short Bio: Xin Yao is a Chair (Professor) of Computer Science and the Director of CERCIA (Centre of Excellence for Research in Computational Intelligence and Applications) at the University of Birmingham, UK. He is an IEEE Fellow and a Distinguished Lecturer of IEEE Computational Intelligence Society (CIS). His work won the 2001 IEEE Donald G. Fink Prize Paper Award, 2010 IEEE Transactions on Evolutionary Computation Outstanding Paper Award, 2010 BT Gordon Radley Award for Best Author of Innovation (Finalist), 2011 IEEE Transactions on Neural Networks Outstanding Paper Award, and many other best paper awards at conferences. He won the prestigious Royal Society Wolfson Research Merit Award in 2012 and was selected to receive the 2013 IEEE CIS Evolutionary Computation Pioneer Award. He was the Editor-in-Chief (2003-08) of IEEE Transactions on Evolutionary Computation and is an Associate Editor or Editorial Member of more than ten other journals. He has been invited to give 65 keynote/plenary speeches at international conferences. His major research interests include evolutionary computation and ensemble learning. Source: Xin Yao website.

Short Bio: Xin Yao is a Chair (Professor) of Computer Science and the Director of CERCIA (Centre of Excellence for Research in Computational Intelligence and Applications) at the University of Birmingham, UK. He is an IEEE Fellow and a Distinguished Lecturer of IEEE Computational Intelligence Society (CIS). His work won the 2001 IEEE Donald G. Fink Prize Paper Award, 2010 IEEE Transactions on Evolutionary Computation Outstanding Paper Award, 2010 BT Gordon Radley Award for Best Author of Innovation (Finalist), 2011 IEEE Transactions on Neural Networks Outstanding Paper Award, and many other best paper awards at conferences. He won the prestigious Royal Society Wolfson Research Merit Award in 2012 and was selected to receive the 2013 IEEE CIS Evolutionary Computation Pioneer Award. He was the Editor-in-Chief (2003-08) of IEEE Transactions on Evolutionary Computation and is an Associate Editor or Editorial Member of more than ten other journals. He has been invited to give 65 keynote/plenary speeches at international conferences. His major research interests include evolutionary computation and ensemble learning. Source: Xin Yao website.

Industry: Alexander Lipton, Managing Director, Enterprise Capital Management, Bank of America Merrill Lynch, USA

Short Bio: Alex Lipton is a Managing Director and Co-Head of the Global Quantitative Group at Bank of America Merrill Lynch, and a Visiting Professor of Mathematics at Imperial College London. Prior to his current role, he was a Managing Director and Head of Capital Structure Quantitative Research at Citadel Investment Group in Chicago; he has also worked at Credit Suisse, Deutsche Bank and Bankers Trust. Previously, Alex was a Full Professor of Mathematics at the University of Illinois at Chicago and a Consultant at Los Alamos National Laboratory. He received his undergraduate and graduate degrees from Lomonosov Moscow State University. His current interests include credit correlation and related topics, quantitative aspects of securitization, as well as technical trading strategies. In 2000 Alex was awarded the first Quant of the Year Award by Risk Magazine. Alex is the author of two books (Magnetohydrodynamics and Spectral Theory and Mathematical Methods for Foreign Exchange) and the editor of three more. He has published numerous research papers on hydrodynamics, magnetohydrodynamics, astrophysics, and financial engineering. Alex has given dozens of invited lectures at leading universities and major conferences worldwide. Source: Alexander Lipton's website.

Short Bio: Alex Lipton is a Managing Director and Co-Head of the Global Quantitative Group at Bank of America Merrill Lynch, and a Visiting Professor of Mathematics at Imperial College London. Prior to his current role, he was a Managing Director and Head of Capital Structure Quantitative Research at Citadel Investment Group in Chicago; he has also worked at Credit Suisse, Deutsche Bank and Bankers Trust. Previously, Alex was a Full Professor of Mathematics at the University of Illinois at Chicago and a Consultant at Los Alamos National Laboratory. He received his undergraduate and graduate degrees from Lomonosov Moscow State University. His current interests include credit correlation and related topics, quantitative aspects of securitization, as well as technical trading strategies. In 2000 Alex was awarded the first Quant of the Year Award by Risk Magazine. Alex is the author of two books (Magnetohydrodynamics and Spectral Theory and Mathematical Methods for Foreign Exchange) and the editor of three more. He has published numerous research papers on hydrodynamics, magnetohydrodynamics, astrophysics, and financial engineering. Alex has given dozens of invited lectures at leading universities and major conferences worldwide. Source: Alexander Lipton's website.

Keynote Speakers:

Michael Dempster, Founder centre for financial research, University of Cambridge, Director, Cambridge Systems Associates, UK

Short Bio: Dr. Dempster was educated at Toronto, Carnegie Mellon and Oxford and is currently Professor Emeritus at the Statistical Laboratory, Centre for Mathematical Sciences. He founded the Centre for Financial Research at the Judge Business School (1996-2008) in the University of Cambridge, where he is also Professor of Management Studies (Finance and Management Science) Emeritus and was previously Director of Research (1997-2000) and Director of the Doctoral Programme (1997-2002).

From 1974-81 he was Chairman of Oxford Systems Associates Limited and from 1974-79 Managing Director. Currently, he is Managing Director (1996 - ) of Cambridge Systems Associates Limited, a financial services consultancy and software company with international patents pending on its Stochastics SuiteTM for optimal financial planning.

He is author of over one hundred published research articles and reports and is author, editor or translator of eleven books, including Introduction to Optimization Methods (with P R Adby), Large Scale Linear Programming (2 vols., with G B Danzig and M Kallio), Stochastic Programming, Deterministic and Stochastic Scheduling (with J K Lenstra and A H G Rinnooy Kan), Mathematics of Derivative Securities (with S R Pliska) and Risk Management: Value at Risk and Beyond. His latest edited work Quantitative Fund Management (co-edited with G Mitra and G Pflug) appears in the Chapman and Hall CRC series on mathematical finance which he co-edits with R Cont and D Madan. He is founding joint Editor-in-Chief of Quantitative Finance with Professor J Doyne Farmer and presently shares this position with J-P Bouchaud. He was formerly a member of the editorial boards of the Review of Economic Studies, Journal of Economic Dynamics and Control, Mathematical Finance and Computational Economics and is currently an associate editor of Stochastics, Computational Finance and the Journal of Risk Management in Financial Institutions. Source: Michael Dempster website.

Short Bio: Dr. Dempster was educated at Toronto, Carnegie Mellon and Oxford and is currently Professor Emeritus at the Statistical Laboratory, Centre for Mathematical Sciences. He founded the Centre for Financial Research at the Judge Business School (1996-2008) in the University of Cambridge, where he is also Professor of Management Studies (Finance and Management Science) Emeritus and was previously Director of Research (1997-2000) and Director of the Doctoral Programme (1997-2002).

From 1974-81 he was Chairman of Oxford Systems Associates Limited and from 1974-79 Managing Director. Currently, he is Managing Director (1996 - ) of Cambridge Systems Associates Limited, a financial services consultancy and software company with international patents pending on its Stochastics SuiteTM for optimal financial planning.

He is author of over one hundred published research articles and reports and is author, editor or translator of eleven books, including Introduction to Optimization Methods (with P R Adby), Large Scale Linear Programming (2 vols., with G B Danzig and M Kallio), Stochastic Programming, Deterministic and Stochastic Scheduling (with J K Lenstra and A H G Rinnooy Kan), Mathematics of Derivative Securities (with S R Pliska) and Risk Management: Value at Risk and Beyond. His latest edited work Quantitative Fund Management (co-edited with G Mitra and G Pflug) appears in the Chapman and Hall CRC series on mathematical finance which he co-edits with R Cont and D Madan. He is founding joint Editor-in-Chief of Quantitative Finance with Professor J Doyne Farmer and presently shares this position with J-P Bouchaud. He was formerly a member of the editorial boards of the Review of Economic Studies, Journal of Economic Dynamics and Control, Mathematical Finance and Computational Economics and is currently an associate editor of Stochastics, Computational Finance and the Journal of Risk Management in Financial Institutions. Source: Michael Dempster website.

J. Doyne Farmer, Professor of Mathematics and Co-Director of Complexity Economics, Institute for New Economic Thinking, Oxford Martin School, University of Oxford, UK

Short Bio:J. Doyne Farmer is an External Professor at the Santa Fe Institute and Co-Director, Complexity Economics, Institute for New Economic Thinking at the Oxford Martin School. He has broad interests in complex systems, and has done research in dynamical systems theory, time series analysis and theoretical biology. At present, his main interest is in developing quantitative theories for social evolution, in particular for financial markets (which provide an accurate record of decision making in a complex environment) and the evolution of technologies (whose performance through time provides a quantitative record of one component of progress). He was a founder of Prediction Company, a quantitative trading firm that was recently sold to the United Bank of Switzerland, and was their chief scientist from 1991 - 1999. During the eighties, he worked at Los Alamos National Laboratory, where he was an Oppenheimer Fellow, founding the Complex Systems Group in the theoretical division. He began his career as part of the U.C. Santa Cruz Dynamical Systems Collective, a group of physics graduate students who did early research into what later came to be called "chaos theory". In his spare time during graduate school, he led a group that designed and built the first wearable digital computers (which were used to beat the game of roulette). For popular press see The Newtonian Casino by Thomas Bass, Chaos by Jim Gleick, Complexity by Mitch Waldrup, and The Predictors by Thomas Bass. Source: J. Doyne Farmer website.

Short Bio:J. Doyne Farmer is an External Professor at the Santa Fe Institute and Co-Director, Complexity Economics, Institute for New Economic Thinking at the Oxford Martin School. He has broad interests in complex systems, and has done research in dynamical systems theory, time series analysis and theoretical biology. At present, his main interest is in developing quantitative theories for social evolution, in particular for financial markets (which provide an accurate record of decision making in a complex environment) and the evolution of technologies (whose performance through time provides a quantitative record of one component of progress). He was a founder of Prediction Company, a quantitative trading firm that was recently sold to the United Bank of Switzerland, and was their chief scientist from 1991 - 1999. During the eighties, he worked at Los Alamos National Laboratory, where he was an Oppenheimer Fellow, founding the Complex Systems Group in the theoretical division. He began his career as part of the U.C. Santa Cruz Dynamical Systems Collective, a group of physics graduate students who did early research into what later came to be called "chaos theory". In his spare time during graduate school, he led a group that designed and built the first wearable digital computers (which were used to beat the game of roulette). For popular press see The Newtonian Casino by Thomas Bass, Chaos by Jim Gleick, Complexity by Mitch Waldrup, and The Predictors by Thomas Bass. Source: J. Doyne Farmer website.

Charles A.E. Goodhart, Emeritus Professor London School of Economics, UK

Short Bio:Charles Goodhart, CBE, FBA is a member of the Financial Markets Group at the London School of Economics, having previously, 1987-2005, been its Deputy Director. Until his retirement in 2002, he was the Norman Sosnow Professor of Banking and Finance at LSE since 1985. Before then, he had worked at the Bank of England for seventeen years as a monetary adviser, becoming a Chief Adviser in 1980. In 1997, he was appointed one of the outside independent members of the Bank of England's new Monetary Policy Committee until May 2000. Earlier, he taught at Cambridge and LSE. Besides numerous articles, he has written a couple of books on monetary history; a graduate monetary textbook, Money, Information and Uncertainty (2nd Ed. 1989); two collections of papers on monetary policy, Monetary Theory and Practice (1984) and The Central Bank and The Financial System (1995); and a number of books and articles on Financial Stability, on which subject he was Adviser to the Governor of the Bank of England, 2002-2004, and numerous other studies relating to financial markets and to monetary policy and history. In his spare time he is a sheep farmer (loss-making). Source: Institute for New Economic Thinking website on Charles Goodhart..

Short Bio:Charles Goodhart, CBE, FBA is a member of the Financial Markets Group at the London School of Economics, having previously, 1987-2005, been its Deputy Director. Until his retirement in 2002, he was the Norman Sosnow Professor of Banking and Finance at LSE since 1985. Before then, he had worked at the Bank of England for seventeen years as a monetary adviser, becoming a Chief Adviser in 1980. In 1997, he was appointed one of the outside independent members of the Bank of England's new Monetary Policy Committee until May 2000. Earlier, he taught at Cambridge and LSE. Besides numerous articles, he has written a couple of books on monetary history; a graduate monetary textbook, Money, Information and Uncertainty (2nd Ed. 1989); two collections of papers on monetary policy, Monetary Theory and Practice (1984) and The Central Bank and The Financial System (1995); and a number of books and articles on Financial Stability, on which subject he was Adviser to the Governor of the Bank of England, 2002-2004, and numerous other studies relating to financial markets and to monetary policy and history. In his spare time he is a sheep farmer (loss-making). Source: Institute for New Economic Thinking website on Charles Goodhart..

Panels

Systemic Risk Panel

David Bholat, Bank of England, Panellist

Short Bio: David Bholat is an Analyst in the Vision Team of the Statistics and Regulatory Data Division within the Bank of England. He is also a visiting fellow at Newcastle University and visiting lecturer at Queen Mary University. His knowledge of financial history is coupled with breadth of international experience and strong analytical skills evidenced by research publications and project outputs. David is a former US-UK Fulbright Fellow, he graduated with highest honors from Georgetown University's School of Foreign Service. He subsequently received his Masters from the London School of Economics and his PhD from the University of Chicago.

Short Bio: David Bholat is an Analyst in the Vision Team of the Statistics and Regulatory Data Division within the Bank of England. He is also a visiting fellow at Newcastle University and visiting lecturer at Queen Mary University. His knowledge of financial history is coupled with breadth of international experience and strong analytical skills evidenced by research publications and project outputs. David is a former US-UK Fulbright Fellow, he graduated with highest honors from Georgetown University's School of Foreign Service. He subsequently received his Masters from the London School of Economics and his PhD from the University of Chicago.

Jon Danielson, London School of Economics and Political Science, Panellist

Short Bio: Jon Danielsson is one of the two Directors of the Systemic Risk Centre at LSE. He holds a PhD in economics from Duke University and is currently a Reader in Finance at LSE. His research interests cover systemic risk, financial risk, econometrics, economic theory and financial crisis. He is also a consultant including past assignments with the IMF and the Bank of Japan.

Jon has written articles and papers published in magazines such as the Financial Times and leading academic journals and books. He has made a number of presentations at financial institutions, public organizations in several countries, international organizations, and universities both in Europe and the US.

Short Bio: Jon Danielsson is one of the two Directors of the Systemic Risk Centre at LSE. He holds a PhD in economics from Duke University and is currently a Reader in Finance at LSE. His research interests cover systemic risk, financial risk, econometrics, economic theory and financial crisis. He is also a consultant including past assignments with the IMF and the Bank of Japan.

Jon has written articles and papers published in magazines such as the Financial Times and leading academic journals and books. He has made a number of presentations at financial institutions, public organizations in several countries, international organizations, and universities both in Europe and the US.

Mark Flood, US Treasury Office of Financial Research, Panellist

Short Bio: Mark Flood is a Financial Economist at the Office of Financial Research in Washington DC. He has taught at universities in the U.S. and Canada, and worked as a financial economist on issues of regulatory policy and risk management at the Federal Reserve Bank of St. Louis, the Office of Thrift Supervision, the Federal Housing Finance Board, and the Federal Housing Finance Agency, and was a founding member of the Committee to Establish a National Institute of Finance. His research has appeared in the Review of Financial Studies, Annual Review of Financial Economics, Quantitative Finance, the Journal of International Money and Finance, and the St. Louis Fed's Review.

Short Bio: Mark Flood is a Financial Economist at the Office of Financial Research in Washington DC. He has taught at universities in the U.S. and Canada, and worked as a financial economist on issues of regulatory policy and risk management at the Federal Reserve Bank of St. Louis, the Office of Thrift Supervision, the Federal Housing Finance Board, and the Federal Housing Finance Agency, and was a founding member of the Committee to Establish a National Institute of Finance. His research has appeared in the Review of Financial Studies, Annual Review of Financial Economics, Quantitative Finance, the Journal of International Money and Finance, and the St. Louis Fed's Review.

Kevin James, Financial Conduct Authority, Panellist

Short Bio: Kevin James is a Technical Specialist in Market Effectiveness at the Financial Conduct Authority. Until recently he was one of the experts on financial stability at the Centre for Central Banking Studies at the Bank of England, and previously worked for the UK Financial Services Authority, and the Securities and Exchange Commission and the Antitrust Division in the US. His areas of expertise are the connections between the financial sector and the real economy and the implications of these connections for financial regulation. Kevin received his PhD from UCLA, and is a Visiting Fellow at the London School of Economics (Financial Markets Group), and a co-organiser of the LSE Financial Regulation seminars.

Short Bio: Kevin James is a Technical Specialist in Market Effectiveness at the Financial Conduct Authority. Until recently he was one of the experts on financial stability at the Centre for Central Banking Studies at the Bank of England, and previously worked for the UK Financial Services Authority, and the Securities and Exchange Commission and the Antitrust Division in the US. His areas of expertise are the connections between the financial sector and the real economy and the implications of these connections for financial regulation. Kevin received his PhD from UCLA, and is a Visiting Fellow at the London School of Economics (Financial Markets Group), and a co-organiser of the LSE Financial Regulation seminars.

Antoaneta Serguieva, University College London, Moderator

Short Bio: Antoaneta is Chair of the Computational Finance and Economics Technical Committee of the IEEE Computational Intelligence Society, and member of the Financial Computing and Analytics Group at University College London. She has been a visiting academic at the Bank of England, a fellow at the New England Complex Systems Institute, and on sabbatical at UC Berkeley. Her research interests cover nature inspired computational intelligence and heuristics in modelling complex socio-technical systems, contagion mechanisms, and cognition. Antoaneta holds a PhD in computer science, MBA in finance, MSc in systems engineering, and works on a PhD in applied mathematics.

Short Bio: Antoaneta is Chair of the Computational Finance and Economics Technical Committee of the IEEE Computational Intelligence Society, and member of the Financial Computing and Analytics Group at University College London. She has been a visiting academic at the Bank of England, a fellow at the New England Complex Systems Institute, and on sabbatical at UC Berkeley. Her research interests cover nature inspired computational intelligence and heuristics in modelling complex socio-technical systems, contagion mechanisms, and cognition. Antoaneta holds a PhD in computer science, MBA in finance, MSc in systems engineering, and works on a PhD in applied mathematics.

Tutorials

Functional Elegance with F# for Financial Computing

Don Syme, Principle Resarcher, Microsoft Research, UK

Short Bio:I am a Principal Researcher at Microsoft Research, Cambridge. I help Microsoft make better programming languages, and, through that, make people more productive and happier.

My main current responsibility is the design and implementation of F# (blog), though I've also worked on C# (being co-responsible for C# and .NET generics) and, indirectly, Visual Basic and other .NET languages.

As a researcher, my area is programming language design and implementation, with emphasis on making functional languages that are simpler to use, interoperate well with other languages and which incorporate aspects of object-oriented, asynchronous and parallel programming. I am interested in programming language perspectives on type inference, concurrency, reactivity, pattern matching and language-oriented programming. I also work extensively with teams in the Microsoft Developer Division on other programming-related technologies.

I am the primary author of Expert F#, published in 2007, and we are now working on a second edition of this book. In the past, I have worked in formal specification, interactive proof, automated verification and proof description languages. I have a PhD from the University of Cambridge and am a member of the WG2.8 working group on functional programming. Source: Microsoft Research.

Short Bio:I am a Principal Researcher at Microsoft Research, Cambridge. I help Microsoft make better programming languages, and, through that, make people more productive and happier.

My main current responsibility is the design and implementation of F# (blog), though I've also worked on C# (being co-responsible for C# and .NET generics) and, indirectly, Visual Basic and other .NET languages.

As a researcher, my area is programming language design and implementation, with emphasis on making functional languages that are simpler to use, interoperate well with other languages and which incorporate aspects of object-oriented, asynchronous and parallel programming. I am interested in programming language perspectives on type inference, concurrency, reactivity, pattern matching and language-oriented programming. I also work extensively with teams in the Microsoft Developer Division on other programming-related technologies.

I am the primary author of Expert F#, published in 2007, and we are now working on a second edition of this book. In the past, I have worked in formal specification, interactive proof, automated verification and proof description languages. I have a PhD from the University of Cambridge and am a member of the WG2.8 working group on functional programming. Source: Microsoft Research.

Algorithmic Trading

Aistis Raudys, Vilnius University, Lithuania

Dr. Aistis Raudys received his PhD from the Institute of Mathematics and Informatics, Lithuania in a field of feature extraction from multidimensional data. Currently he works as senior research fellow at Vilnius University Faculty of Mathematics and Informatics where he teaches algorithmic trading technologies. Previously Aistis worked as a researcher and also as a software developer in various software companies. He collaborated with number of top tier banks including Deutsche Bank, Société Générale and BNP Paribas. Aistis’s research interests are in machine learning for financial engineering and automated trading. He is the author of 21 publications and scientific works. Alongside academic activity Aistis is a partner of the first algorithmic trading hedge fund in Lithuania where he applies his scientific experience in practice.

Dr. Aistis Raudys received his PhD from the Institute of Mathematics and Informatics, Lithuania in a field of feature extraction from multidimensional data. Currently he works as senior research fellow at Vilnius University Faculty of Mathematics and Informatics where he teaches algorithmic trading technologies. Previously Aistis worked as a researcher and also as a software developer in various software companies. He collaborated with number of top tier banks including Deutsche Bank, Société Générale and BNP Paribas. Aistis’s research interests are in machine learning for financial engineering and automated trading. He is the author of 21 publications and scientific works. Alongside academic activity Aistis is a partner of the first algorithmic trading hedge fund in Lithuania where he applies his scientific experience in practice.

Technical Sessions

Tentative program

R1: Registration

Thursday, March 27, 8:00AM-9:00AM, Room:

Plenary Talk P1: Opening of CIFEr 2014 by the General Chair, Antoaneta Serguieva, and Inaugural Lectures by Alex Lipton and Xin Yao

Thursday, March 27, 9:00AM-9:45AM, Room: Auditorium, Speaker: Antoaneta Serguieva, Alex Lipton and Xin Yao

Session 1A: Financial Markets 1

Thursday, March 27, 9:50AM-11:05AM, Room 1, Chair: Christian Oesch

| 9:50AM | An Analysis of Price Impact Functions of Individual Trades on the London Stock Exchange [#1079] |

| Mateusz Wilinski, Wei Cui and Anthony Brabazon | |

| University of Warsaw, Poland; University College Dublin, Ireland | |

| 10:15AM | Survival Models for the Duration of Bid-Ask Spread Deviations [#1078] |

| Efstathios Panayi and Gareth Peters | |

| UCL, United Kingdom | |

| 10:40AM | An Agent-Based Model for Market Impact [#1025] |

| Christian Oesch | |

| University of Basel, Switzerland |

Session 1B: Forecasting 1

Thursday, March 27, 9:50AM-11:05AM, Room 2, Chair: Leandro Maciel

| 9:50AM | Time Series Prediction with a Non-Causal Neural Network [#1072] |

| Yicun Ouyang and Hujun Yin | |

| School of Electrical and Electronic Engineering, The University of Manchester, United Kingdom | |

| 10:15AM | A Comparison of Forecasting Approaches for Capital Markets [#1093] |

| Scott McDonald, Sonya Coleman, Martin McGinnity, Yuhua Li and Ammar Belatreche | |

| Intelligent Systems Research Centre, University of Ulster, United Kingdom | |

| 10:40AM | Exchange Rate Forecasting Using Echo State Networks for Trading Strategies [#1067] |

| Leandro Maciel, Fernando Gomide, David Santos and Rosangela Ballini | |

| University of Campinas, Brazil |

Session 1C: Text Mining and Sentiment Analysis 1

Thursday, March 27, 9:50AM-11:05AM, Room 3, Chair: Steve Yang

| 9:50AM | From Text to Bank Interrelation Maps [#1031] |

| Samuel Ronnqvist and Peter Sarlin | |

| Abo Akademi University, Finland; Goethe University Frankfurt, Germany | |

| 10:15AM | An Empirical Study of the Financial Community Network on Twitter [#1083] |

| Steve Yang, Sheung Yin Mo and Xiaodi Zhu | |

| Stevens Institute of Technology, United States | |

| 10:40AM | Twitter Financial Community Modeling using Agent Based Simulation [#1064] |

| Steve Yang, Anqi Liu and Sheung Yin Mo | |

| Stevens Institute of Technology, United States |

Session 2A: Financial Markets 2

Thursday, March 27, 11:30AM-12:45PM, Room 1, Chair: Christian Oesch

| 11:30AM | Do Dark Pools Stabilize Markets and Reduce Market Impacts? -- Investigations using Multi-Agent Simulations -- [#1029] |

| Takanobu Mizuta, Shintaro Kosugi, Takuya Kusumoto, Wataru Matsumoto and Kiyoshi Izumi | |

| SPARX Asset Management Co. Ltd. and School of Engineering, The University of Tokyo, Japan; Nomura Securities Co., Ltd., Japan; School of Engineering, The University of Tokyo and CREST, JST, Japan | |

| 11:55AM | Detecting Price Manipulation in the Financial Market [#1073] |

| Yi Cao, Yuhua Li, Sonya Coleman, Ammar Belatreche and Thomas Martin McGinnity | |

| Mr, United Kingdom; Dr, United Kingdom; Professor, United Kingdom | |

| 12:20PM | Detecting Wash Trade in the Financial Market [#1074] |

| Yi Cao, Yuhua Li, Sonya Coleman, Ammar Belatreche and Thomas Martin McGinnity | |

| Mr, United Kingdom; Dr, United Kingdom; Professor, United Kingdom |

Session 2B: Portfolios 1

Thursday, March 27, 11:30AM-12:45PM, Room 2, Chair: Manfred Gilli

| 11:30AM | Improving Portfolio Risk Profile with Threshold Accepting [#1026] |

| Manuel Kleinknecht and Wing Lon Ng | |

| University of Essex, United Kingdom | |

| 11:55AM | Multi-Period Asset Allocation with Lower Partial Moments Criteria and Affine Policies [#1051] |

| Giuseppe Calafiore and Fatemeh Kharaman | |

| Politecnico di Torino, Italy; Universita di Trento, Italy | |

| 12:20PM | Better Portfolios with Options [#1020] |

| Gerda Cabej, Manfred Gilli and Enrico Schumann | |

| University of Geneva, Switzerland; University of Geneva and Swiss Finance Institute, Switzerland; Aquila Capital Group, Switzerland |

Session 2C: Text Mining and Sentiment Analysis 2

Thursday, March 27, 11:30AM-12:45PM, Room 3, Chair: John Yaros

| 11:30AM | Exchange Rate Prediction with Sentiment Indicators - an Empirical Evaluation using Text Mining and Multilayer Perceptrons [#1114] |

| Sven F. Crone and Christian Koeppel | |

| Lancaster University Management School, United Kingdom | |

| 11:55AM | Preprocessing Online Financial Text for Sentiment Classification: A Natural Language Processing Approach [#1106] |

| Fan Sun, Ammar Belatreche, Sonya Coleman, Martin McGinnity and Yuhua Li | |

| the University of Ulster, United Kingdom | |

| 12:20PM | Diversification Improvements Through News Article Co-occurrences [#1081] |

| John Yaros and Tomasz Imielinski | |

| Rutgers University, United States |

Plenary Talk P2: Plenary Talk by Doyne Farmer

Thursday, March 27, 1:30PM-2:15PM, Room: Auditorium, Speaker: Doyne Farmer

Session 3A: Financial Markets 3

Thursday, March 27, 2:20PM-3:35PM, Room 1, Chair: Takanobu Mizuta

| 2:20PM | Regulations' Effectiveness for Market Turbulence by Large Mistaken Orders using Multi Agent Simulation [#1028] |

| Takanobu Mizuta, Kiyoshi Izumi, Isao Yagi and Shinobu Yoshimura | |

| SPARX Asset Management Co. Ltd. and School of Engineering, The University of Tokyo, Japan; School of Engineering, The University of Tokyo and CREST, JST, Japan; Faculty of Information Technology, Kanagawa Institute of Technology, Japan; School of Engineering, The University of Tokyo, Japan | |

| 2:45PM | A mesoscopic approach to modeling and simulation of systemic risks [#1019] |

| Ide Kiyotaka, Zamami Ryota and Namatame Akira | |

| National Defense Academy of Japan, Japan | |

| 3:10PM | Impact of credit default swaps on financial contagion [#1011] |

| Yoshiharu Maeno, Kenji Nishiguchi, Satoshi Morinaga and Matsushima Hirokazu | |

| NEC Corporation, Japan; Japan Research Institute, Japan; Institute for International Socio-economic Studies, Japan |

Session 3B: Portfolios 2

Thursday, March 27, 2:20PM-3:35PM, Room 2, Chair: Phil Maguire

| 2:20PM | Portfolio Optimization Using Fundamental Indicators Based on Multi-Objective EA [#1092] |

| Antonio Silva, Rui Neves and Nuno Horta | |

| Instituto Superior Tecnico, Portugal; Instituto de Telecomunicacoes, Portugal | |

| 2:45PM | Constructing Smart Portfolios From Data Driven Quantitative Investment Models [#1104] |

| Chetan. Saran Mehra, Prugle-Bennett Adam, Gerding Enrico and Robu Valentin | |

| University of Southampton, United Kingdom | |

| 3:10PM | Maximizing positive portfolio diversification [#1012] |

| Phil Maguire, Philippe Moser, Keiran O' Reilly, Conor McMenamin and Rebecca Maguire | |

| NUI Maynooth, Ireland; National College of Ireland, Ireland |

Session 3C: Risk and Forecasting

Thursday, March 27, 2:20PM-3:35PM, Room 3, Chair: Viorel Milea

| 2:20PM | Volatility Homogenisation Decomposition for Forecasting [#1022] |

| Adam Kowalewski, Owen Jones and Ramamohanarao Kotagiri | |

| The University of Melbourne, Australia | |

| 2:45PM | A Hidden Markov Reduced-form Risk Model [#1052] |

| Jia-Wen Gu, Wai-Ki Ching and Harry Zheng | |

| The University of Hong Kong, Hong Kong; Imperial College, United Kingdom | |

| 3:10PM | A Framework for Web News Items Analysis in Relation to Company Stock Prices [#1018] |

| Robert Max van Essen, Viorel Milea and Flavius Frasincar | |

| Erasmus University Rotterdam, Netherlands |

Plenary Talk P3: Plenary Talk by Charles Goodhart

Thursday, March 27, 4:00PM-4:45PM, Room: Auditorium, Speaker: Charles Goodhart

Panel Session P4: Systemic Risk

Thursday, March 27, 4:45PM-5:45PM, Room: Auditorium, Chair: Kevin James and Antoaneta Serguieva

Plenary Poster Session PS: Poster Session

Thursday, March 27, 5:45PM-6:15PM, Room: Auditorium, Chair: Dietmar Maringer

| P101 | Modelling the dynamics of the "Smarter Region" [#1005] |

| Andranik Akopov and Gayane Beklaryan | |

| National Research University Higher School of Economics, Russia; Analytical Centre CEMI-GENKEY, Russia | |

| P102 | High Frequency Trading An Analysis Regarding Volatility And Liquidity Starting From A Base Case Of Algorithms And A Dedicated Software Architecture [#1009] |

| Giulio Carlone | |

| University of Chieti and Pescara, Italy | |

| P103 | Mixed Precision Multilevel Monte Carlo on Hybrid Computing Systems [#1021] |

| Christian Brugger, Christian de Schryver, Norbert Wehn, Steffen Omland and Mario Hefter | |

| Microelectronic Systems Design Research Group, University of Kaiserslautern, Germany, Germany; Computational Stochastics Research Group, University of Kaiserslautern, Germany, Germany | |

| P104 | Bibliometric Analysis in Financial Research [#1033] |

| Jose M. Merigo and Jian-Bo Yang | |

| University of Manchester, United Kingdom | |

| P105 | Engineering Financial Engineering [#1039] |

| Gary Boetticher | |

| University of Houston - Clear Lake, United States | |

| P106 | Optimal Negative Weight Moving Average for Stock-Price Series Smoothing [#1044] |

| Aistis Raudys | |

| Vilnius University Faculty of Mathematics and Informatics, Lithuania | |

| P107 | Frequency Effects on Predictability of Stock Returns [#1047] |

| Pawel Fiedor | |

| Cracow University of Economics, Poland | |

| P108 | Quality and Consistency Assurance of Quote Data for Algorithmic Trading Strategies [#1048] |

| Sven Koschnicke, Vasco Grossmann, Christoph Starke and Manfred Schimmler | |

| Christian-Albrechts-University of Kiel, Germany | |

| P109 | Multiagent Pre-trade Analysis Acceleration in FPGA [#1059] |

| Eduardo Gerlein, T.M. McGinnity, Ammar Belatreche, Sonya Coleman and Li Yuhua | |

| University of Ulster, United Kingdom | |

| P110 | Modelling the Relationship Between Developed Equity Markets and Emerging Equity Markets [#1061] |

| Zvonko Kostanjcar, Zeljan Juretic and Branko Jeren | |

| University of Zagreb, Croatia; Universita Commerciale Luigi Bocconi, Italy | |

| P111 | Causal Inference from Financial Factors: Continuous Variable based Local Structure Learning Algorithm [#1070] |

| Jianjun Yang, Yunhai Tong, Xinhai Liu and Shaohua Tan | |

| Peking University, China; Credit Reference Center, People's Bank of China, China | |

| P112 | Predicting Equity Market Impact with Performance Weighted Ensembles of Random Forests [#1080] |

| Ash Booth, Enrico Gerding and Frank McGroarty | |

| University of Southampton, United Kingdom | |

| P113 | Micro-price Trading in an Order-driven Market [#1111] |

| Andrew Todd, Roy Hayes, Peter Beling and William Scherer | |

| University of Virginia, United States | |

| P114 | Role of Price in Industry Dynamics: A Modular Perspective [#1120] |

| Bin-Tzong Chie and Shu-Heng Chen | |

| Tamkang University, Taiwan; National Chengchi University, Taiwan |

Tutorial T1: Algorithmic Trading

Friday, March 28, 8:30AM-9:45AM, Room: Auditorium, Instructor: Aistis Raudys

Session 4A: Volatility Modeling

Friday, March 28, 9:50AM-11:05AM, Room 1, Chair: Felipe A. Tobar

| 9:50AM | On the Calibration of Stochastic Volatility Models: A Comparison Study [#1007] |

| Jia Zhai and Yi Cao | |

| Dr, United Kingdom; Mr, United Kingdom | |

| 10:15AM | Nonlinear Filtering of Asymmetric Stochastic Volatility Models and Value-at-Risk Estimation [#1016] |

| Nikolay Nikolaev, Lilian de Menezes and Evgueni Smirnov | |

| Department of Computing, Goldsmiths College, University of London, London SE14 6NW, United Kingdom; Cass Business School, City University, London, London EC1Y 8TZ,, United Kingdom; Department of Knowledge Engineering, Faculty of Humanities and Science, Maastricht University, Maastricht 6200 MD, Netherlands | |

| 10:40AM | Estimation of Financial Indices Volatility Using a Model with Time-Varying Parameters [#1071] |

| Felipe Tobar, Marcos Orchard, Danilo Mandic and Anthony Constantinides | |

| Imperial College London, United Kingdom; Universidad de Chile, Chile |

Session 4B: Forecasting and Algorithmic Trading

Friday, March 28, 9:50AM-11:05AM, Room 2, Chair: Jin Zhang

| 9:50AM | Guided Fast Local Search for Speeding Up a Financial Forecasting Algorithm [#1090] |

| Ming Shao, Dafni Smonou, Michael Kampouridis and Edward Tsang | |

| University of Essex, United Kingdom; University of Kent, United Kingdom | |

| 10:15AM | Combining Different Meta-heuristics to Improve the Predictability of a Financial Forecasting Algorithm [#1091] |

| Babatunde Aluko, Dafni Smonou, Michael Kampouridis and Edward Tsang | |

| University of Essex, United Kingdom; University of Kent, United Kingdom | |

| 10:40AM | Forecasting Stock Price Directional Movements using Technical Indicators: Investigating Window Size Effects on One-step-ahead Forecasting [#1099] |

| Yauheniya Shynkevich, T. Martin McGinnity, Sonya Coleman, Yuhua Li and Ammar Belatreche | |

| University of Ulster, United Kingdom |

Special Session 4C: Agent-Based Computational Economics 1

Friday, March 28, 9:50AM-11:05AM, Room 3, Chair: Shu-Heng Chen

| 9:50AM | How Agent-Based Modeling and Simulation relates to CGE and DSGE Modeling [#1117] |

| Claudius Graebner | |

| University of Bremen, Institute of Institutional and Innovation Economics, Germany | |

| 10:15AM | Technological Progress And Effects Of (Supra)Regional Innovation And Production Collaboration. An Agent-Based Model Simulation Study. [#1122] |

| Ben Vermeulen and Andreas Pyka | |

| Institute of Innovation Economics, University of Hohenheim, Stuttgart, Germany | |

| 10:40AM | Learning to be risk averse? [#1075] |

| Robert Marks | |

| University of New South Wales, Australia |

Session 5A: Derivative Pricing

Friday, March 28, 11:30AM-12:45PM, Room 1, Chair: Chuan-Ju Wang

| 11:30AM | Pricing Window Barrier Options with a Hybrid Stochastic-Local Volatility Model [#1054] |

| Yu Tian, Zili Zhu, Geoffrey Lee, Thomas Lo, Fima Klebaner and Kais Hamza | |

| School of Mathematical Sciences, Monash University, Australia; CSIRO Computational Informatics, Australia | |

| 11:55AM | A Kalman Filtering approach for detection of option mispricing in the Black-Scholes PDE model [#1055] |

| Gerasimos Rigatos | |

| Industrial Systems Institute / Unit of Industrial Automation, Greece | |

| 12:20PM | Optimal Search for Parameters in Monte Carlo Simulation for Derivative Pricing [#1010] |

| Chuan-Ju Wang and Ming-Yang Kao | |

| University of Taipei, Taiwan; Northwestern University, United States |

Session 5B: Algorithmic Trading 1

Friday, March 28, 11:30AM-12:45PM, Room 2, Chair: Jin Zhang

| 11:30AM | Risk-averse Reinforcement Learning for Algorithmic Trading [#1077] |

| Yun Shen, Ruihong Huang, Chang Yan and Klaus Obermayer | |

| Technical University Berlin, Germany; Humboldt University Berlin, Germany | |

| 11:55AM | Using Equity Analyst Coverage to Determine Stock Similarity [#1068] |

| John Yaros and Tomasz Imielinski | |

| Rutgers University, United States | |

| 12:20PM | Transition Variable Selection for Regime Switching Recurrent Reinforcement Learning [#1017] |

| Dietmar Maringer and Jin Zhang | |

| University of Basel, Switzerland |

Special Session 5C: Agent-Based Computational Economics 2

Friday, March 28, 11:30AM-12:45PM, Room 3, Chair: Manuel Waeckerle

| 11:30AM | Simulating Natural Disasters - A Complex Systems Framework [#1121] |

| Ali Asjad Naqvi and Miriam Rehm | |

| Vienna University of Economics and Business, Austria; Chamber of Labor, Austria | |

| 11:55AM | Wealth Inequality and Wealth Effect [#1118] |

| Weihong Huang and Yu Zhang | |

| Nanyang Technological University, Singapore | |

| 12:20PM | A computational agent-based simulation of an artificial monetary union for dynamic comparative institutional analysis [#1119] |

| Bernhard Rengs and Manuel Waeckerle | |

| Vienna University of Technology, Austria; Vienna University of Economics and Business, Austria |

Plenary Talk P6: Plenary Talk

Friday, March 28, 1:30PM-2:15PM, Room: Auditorium, Speaker: Michael Dempster

Session 6A: Hedging

Friday, March 28, 2:20PM-3:35PM, Room 1, Chair: Easwar Subramanian

| 2:20PM | On Pricing and Hedging Basket Credit Derivatives with Dependent Structure [#1053] |

| Dong-Mei Zhu, Yue Xie, Wai-Ki Ching and Harry Zheng | |

| The University of Hong Kong, Hong Kong; Imperial College, United Kingdom | |

| 2:45PM | Dynamic Hedging of Foreign Exchange Risk using Stochastic Model Predictive Control [#1082] |

| Farzad Noorian and Philip Leong | |

| University of Sydney, Australia | |

| 3:10PM | Explicit Solutions of Discrete-time Quadratic Optimal Hedging Strategies for European Contingent Claims [#1045] |

| Easwar Subramanian and Vijaysekhar Chellaboina | |

| Tata Consultancy Services, India |

Session 6B: Algorithmic Trading and High Frequency Trading

Friday, March 28, 2:20PM-3:35PM, Room 2, Chair: Patrick Gabrielsson

| 2:20PM | A reinforcement learning extension to the Almgren-Chriss framework for optimal trade execution [#1041] |

| Dieter Hendricks and Diane Wilcox | |

| University of the Witwatersrand, South Africa | |

| 2:45PM | Enhancing Intraday Trading Performance of Neural Network using Dynamic Volatility Clustering Fuzzy Filter [#1013] |

| Vincent Vella and Wing Lon Ng | |

| University of Essex, United Kingdom | |

| 3:10PM | Co-Evolving Online High-Frequency Trading Strategies Using Grammatical Evolution [#1100] |

| Patrick Gabrielsson, Ulf Johansson and Rikard Konig | |

| School of Business and IT, University of Boras, Sweden |

Session 6C: Forecasting 2

Friday, March 28, 2:20PM-3:35PM, Room 3, Chair: Rui Jorge Almeida

| 2:20PM | Evolving Hybrid Neural Fuzzy Network for Realized Volatility Forecasting with Jumps [#1060] |

| Raul Rosa, Leandro Maciel, Fernando Gomide and Rosangela Ballini | |

| University of Campinas, Brazil | |

| 2:45PM | Classification System for Mortgage Arrear Management [#1084] |

| Zhe Sun, Marco Wiering and Nicolai Petkov | |

| Johan Bernoulli Institute of Mathematics and Computing Science, University of Groningen, Netherlands; Institute of Artificial Intelligence and Cognitive Engineering, University of Groningen, Netherlands | |

| 3:10PM | Probabilistic Fuzzy Systems for Seasonality Analysis and Multiple Horizon Forecasts [#1115] |

| Rui Jorge Almeida, Nalan Basturk and Uzay Kaymak | |

| Eindhoven University of Technology, School of Industrial Engineering, Netherlands; Erasmus University Rotterdam, Erasmus School of Economics, Department of Econometrics, Netherlands |

Tutorial T2: Functional Elegance with F# for Financial Computing

Friday, March 28, 4:00PM-5:15PM, Room: Auditorium, Instructor: Don Syme

Competition T3: Trading Competition

Friday, March 28, 5:15PM-5:45PM, Room: Auditorium, Chair: Peter Beling

P7: Closing

Friday, March 28, 5:45PM-6:15PM, Room: Auditorium, Chair: Antoaneta Serguieva